Eduardo González

This past Tuesday, the Council of Ministers authorized the signing of the agreement between Spain and the United Arab Emirates (UAE) for the Promotion and Reciprocal Protection of Investments.

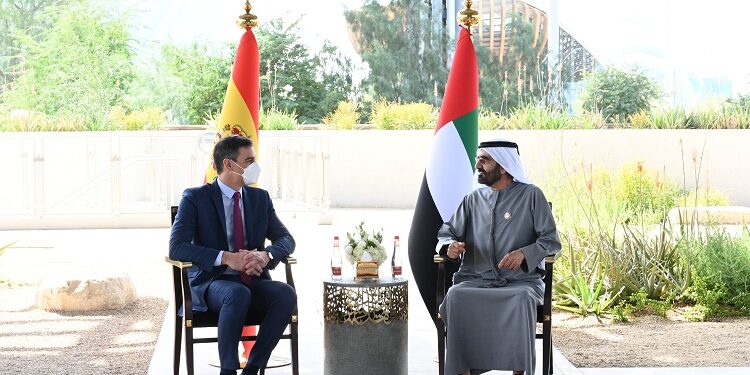

The agreement, whose negotiations began in 2003, was sealed by the President of the Government, Pedro Sánchez, in February 2022, during an official visit to the Emirates. Likewise, the European Commission authorized Spain to sign the text agreed with the United Arab Emirates in March 2023.

During that visit to the Emirates, in which he traveled accompanied by the Minister of Foreign Affairs, José Manuel Albares; the then Minister of Industry, Commerce and Tourism, Reyes Maroto; and the Secretary of State for Commerce, Xiana Méndez, Sánchez took advantage of the inauguration of the Spain-UAE Business Meeting (organized by ICEX within the framework of the celebration of Spain Day at the Dubai Universal Exhibition) to try to attract the interest of recovery funds towards the Government’s Recovery Plan and to encourage them to “look at Spain as a great country to invest in and win the future.”

Likewise, during that visit – in which he was received by the Emir of Abu Dhabi and President of the United Arab Emirates, Khalifa Mohamed bin Zayed bin Sultan Al Nahayan, and by the Emir of Dubai and Vice President of the Emirates, Sheikh Mohammed bin Rashid Al Maktoum-, Pedro Sánchez closed not only the aforementioned Agreement for the Protection and Reciprocal Promotion of Investments, but also a Memorandum of Understanding (MoU) between Mubadala (the large sovereign fund of Abu Dhabi) and COFIDES (Spanish Development Financing Company) for the identification and joint financing of projects.

The United Arab Emirates is currently in the process of economic diversification to reduce its dependence on oil, which continues to generate a third of its GDP. For this reason, its Government is especially interested in attracting foreign investments, which represents a good opportunity for Spanish companies in sectors such as renewable energy, transport, air traffic or tourism. The Emirates is the third world producer of crude oil and has the second GDP in the region, after Saudi Arabia, and the third per capita income (PRC), after Kuwait and Qatar.

According to the Foreign Investment Registry, the stock of Spanish investment in the Emirates was, as of December 31, 2018 (latest data available), 2,989 million euros, which places this country in the twenty-first destination of Spanish investments. However, Spanish gross investment flows in the Emirates are low (10.4 million euros in 2019) due to the impossibility, until recently, of opening purely Spanish-owned subsidiaries in the Emirates, which is why many of the companies installed companies have resorted to legal figures (branches or representative offices) that do not involve capital outlays or have chosen to open subsidiaries in free zones, where they can have one hundred percent of the property but whose scope of action is limited to that free zone.

On the other hand, the Emirates’ investment in Spain is much more relevant. The stock of investments in 2018 (latest figure available) reached 5,851 million euros, which places the UAE in thirteenth place among the countries that invest in Spain. In 2020, the Emirates’ gross investment in Spain amounted to 64 million euros.

The main Emirati investments in Spain have been carried out through Sovereign Funds or private funds, mostly owned by the royal family. The main Emirati investment in Spain, by far, has fallen on the Spanish Petroleum Company (CEPSA), in which Mubadala Investment Company controls 60% of the capital. In addition, Mubadala controls 3% of the capital of ENAGÁS, valued at market prices at around 160 million euros, and Dubai Ports World has been the concessionaire for the management of the Port of Tarragona since mid-2008.