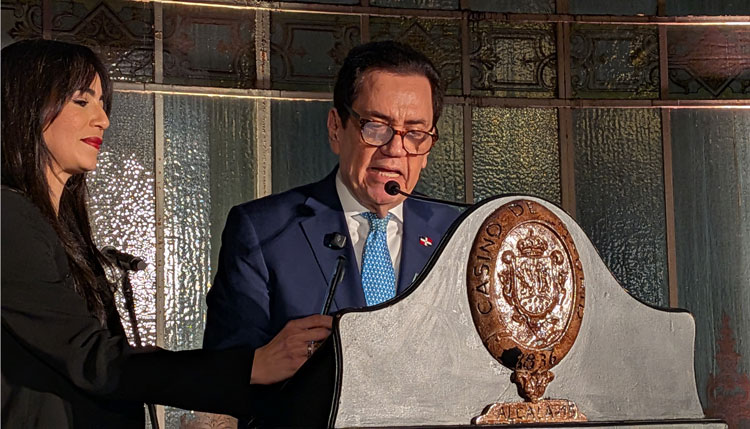

Eduardo González

This past Tuesday, the Council of Ministers authorized the signing of the new Social Security Agreement between Spain and the United States.

The current Social Security Agreement between Spain and the United States, signed on September 30, 1986, has been in force since April 1, 1988. In February 2012, Spain proposed its modification in order to adapt it to internal legislative changes. and current conventional techniques. After a long negotiating process, in May 2017 an agreement was reached on the drafting of the new agreement and the administrative agreement for its application.

The entry into force of the EU Regulation of April 2016 regarding the protection of natural persons with regard to the processing of their personal data, as well as the entry into force of the Organic Law of December 2018 on the protection of personal data and guarantee of digital rights, made it necessary to adapt the content of the articles on data protection to guarantee the requirements of both regulations, finally reaching an agreement in May 2023.

The agreement contemplates basic aspects of the Social Security coordination rules, such as equal treatment (the foreign worker must be treated in the same way as the national worker, with the same benefits and the same obligations), the totalization of contributions (the periods contributed in the different countries are recognized when requesting benefits in any signatory country), the export of benefits (the benefit, especially if it is contributory, “travels” with the person who leaves the country in which has that benefit recognized) and the uniqueness of the applicable legislation.

This agreement is applicable only to the contributory benefits of the Social Security System (retirement, permanent disability and death and survival derived from common contingencies) and to those of the State Passive Classes Regime, in the case of Spain, which constitutes a novelty. The provision of health care and other non-contributory benefits is excluded, so its application has no economic impact on the Public Treasury.

Although the movement of workers from one country to another is becoming more frequent, there is no international system that coordinates worker contributions and benefits in different States. The exception is the European Union, where Social Security systems are coordinated through Community Law, which is mandatory in all member countries, and where the recognition of contributions is much more agile because there are rules that apply to all the member states.

For this reason, bilateral Social Security agreements between countries are the instrument used to try to guarantee workers’ benefits. Spain, a transmitter and receiver of emigrants, is one of the countries in the world with the most bilateral agreements of this type, specifically with 25 countries: Andorra, Argentina, Australia, Brazil, Cape Verde, Canada, Chile, China, Colombia, Republic of Korea, Ecuador, United States, Philippines, Japan, Morocco, Mexico, Paraguay, Peru, Dominican Republic, Russia, Senegal, Tunisia, Ukraine, Uruguay and Venezuela.