The Diplomat

The Official State Gazette has published the new Agreement between Spain and Japan to eliminate double taxation in relation to income taxes and to prevent tax avoidance and evasion and its Protocol, which replaces the previous one of 1974 and will enter into force on 1 May next.

The text, which will affect Spanish nationals residing in Japan and Japanese nationals residing in Spain with regard to income taxes in both countries, renews the bilateral framework on double taxation in order to adapt it to the new regulations on international income transactions. The previous agreement was signed in 1974 and has applied, in both countries, to income and corporate taxes.

Negotiations on the new agreement began in April 2017 in Tokyo with the aim of adapting the 1974 agreement to the new regulations on international income transactions, “which were not so important before and are now more standardised”, as the Japanese Embassy in Spain informed The Diplomat at the time.

More specifically, as reported by the Council of Ministers after its approval last July, the aim of the new agreement is to “enable tax treatment appropriate to the circumstances of taxpayers who carry out economic activities in the international sphere” and to provide an updated framework of legal and fiscal security.

In addition, the text incorporates the standards of the Organisation for Economic Co-operation and Development (OECD) and establishes criteria for the taxation of real estate income, business profits, maritime and air transport, associated companies, dividends, interest, royalties, capital gains, income from dependent work, directors’ fees, income of artists and sportsmen and women, pensions, civil service, students and other income.

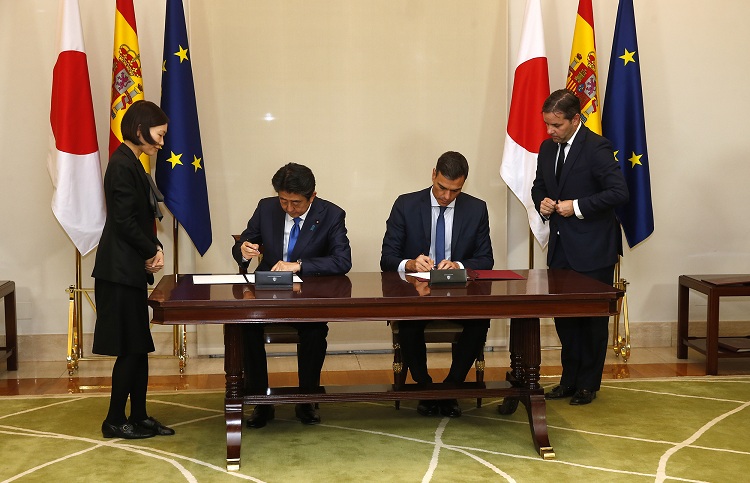

The agreement was signed in Madrid on 16 October 2018, a few days after its authorisation by the Council of Ministers and on the occasion of the meeting between the President of the Government, Pedro Sánchez, and the Prime Minister of Japan, Shinzo Abe.

Japan is the twelfth largest investor in Spain in terms of stock, with an investment of €10.26 billion according to 2018 figures and with an all-time high of €914 million in 2018, which dropped notably to less than €194 million, in 2019. Although Japan is the sixth country by volume of outward investment (UNCTAD 2019), Japanese direct investment (FDI) in Spain shows a very small percentage of Japan’s total stock of total direct investment abroad (0.4% of the total).

Conversely, Spanish investment in Japan was $763 million in 2018, only 0.27% of total FDI received by Japan. Spanish gross direct investment flows to Japan in 2018 and 2019 were negative and Spanish disinvestment in Japan exceeded investment. In terms of stock, Spanish investment in Japan is €272.83 billion, according to 2018 figures. Japanese investment generates more than 35,000 direct jobs in Spain and Spanish investment generates barely 5,000 jobs in Japan.