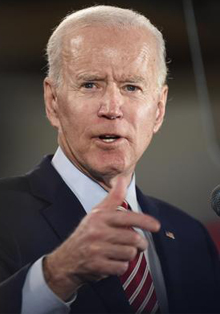

Tomorrow at 5 p.m., Casa América, together with the Fundación Alternativas, will analyse Biden’s tax revolution and the consequences it will have for Europe and Latin America?

The Biden Administration has launched important initiatives in the USA with new taxes on wealth, large estates and multinational companies to tackle the ravages of the pandemic and reduce inequality. This is driving change and accelerating international and national tax reform processes in the European Union, as well as in Latin America. The new international tax compact on multinational taxation reached by the G20, along the lines of the OECD, could be an important part of a major transformation that will eventually tackle malpractices such as tax avoidance and evasion. The so-called “tax revolution” would be associated with a new economic and social paradigm that aims to leave neoliberalism behind and advance new taxes to sustain multi-billion dollar spending packages on public services such as health, education, digital and environmental innovation.

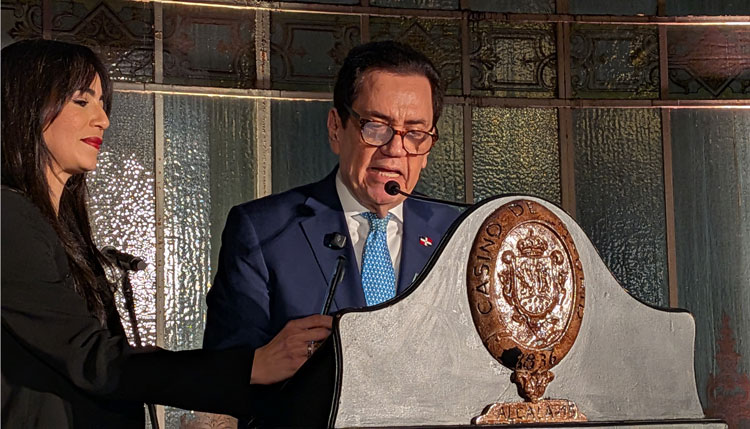

The colloquium will be presented and moderated by Vicente Palacio, director of foreign policy at Fundación Alternativas; Alicia Bárcena, executive secretary of ECLAC; Dalmiro Morán, international consultant specialising in tax reform in Latin America; Ignacio González, professor of economics at American University, and Susana Ruiz, head of tax justice at Oxfam International.